Loading

Get Form No. 15g 197a(1a) 29c 2. - Icici Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM NO. 15G 197A(1A) 29C 2. - ICICI Bank online

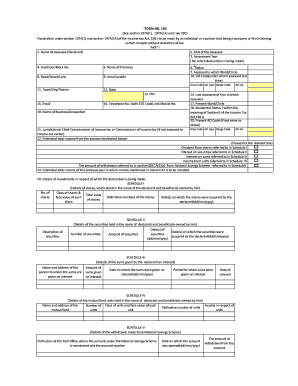

Filling out FORM NO. 15G 197A(1A) 29C 2. - ICICI Bank is essential for individuals seeking to claim certain receipts without tax deductions. This guide provides clear and detailed instructions for completing the form online, ensuring all necessary information is accurately submitted.

Follow the steps to complete the form accurately.

- To begin the process, click the ‘Get Form’ button to retrieve the form and ensure it opens in your preferred editing tool.

- In Part I, fill in your personal details: start with your name as the assessee (declarant) and enter your PAN (Permanent Account Number). Next, indicate the assessment year for which you are making this declaration.

- Continue entering your address details by providing the flat/door/block number, name of the premises, road/street/lane, area/locality, town/city/district, and state. Complete this section with your PIN code.

- Indicate your status and the ward/circle under which you were last assessed. Additionally, provide the AO code related to your last assessment.

- Next, provide your contact information, including your email and telephone numbers (with STD code and mobile number). These details are vital for communication regarding your declaration.

- Outline your business or occupation under the relevant section to provide context regarding your income sources.

- Estimate your total income from the specified sources in the form, ensuring that it does not exceed the maximum amount that is not chargeable to income tax.

- In Schedules I to V, provide requisite details regarding shares, securities, interest-bearing sums, mutual fund units, and National Savings Scheme withdrawals. Fill out each schedule with the required information like distinctive numbers, amounts, and applicable dates.

- Finally, in the Declaration/Verification section, sign and date the form, confirming that all information provided is correct and complete to the best of your knowledge.

- After completing the form, you can save changes, download it for your records, print a copy for signature, or share it with the relevant authority as needed.

Complete your documents online today to ensure timely processing!

You can verify if FORM NO. 15G 197A(1A) 29C 2. - ICICI Bank has been submitted through your bank’s online platform or by contacting customer service. Many banks provide tracking options within their online portals for convenience. Always keep a record of your submissions for future reference.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.