Loading

Get Riverside County Property Tax Bill 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Riverside County Property Tax Bill online

This guide provides clear and instructive steps on how to accurately fill out the Riverside County Property Tax Bill online. Whether you are familiar with tax forms or are navigating this process for the first time, this guide aims to support you every step of the way.

Follow the steps to complete your online property tax bill efficiently.

- Click 'Get Form' button to obtain the Riverside County Property Tax Bill form and open it for editing.

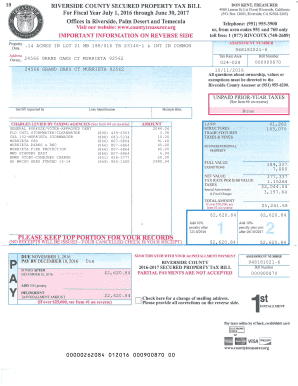

- Review the assessment number located at the top of the form. This unique identifier is essential for all tax-related inquiries.

- Verify the property address and owner's name shown on the form. Ensure your information is accurate as this affects tax liability.

- Check the tax rate area and bill number. These fields help to categorize your tax obligations properly.

- Examine the charges levied by taxing agencies section. This will outline the specific charges applicable to your property, which include local assessments and general-purpose funds.

- Calculate the total amount due for each installment, including any penalties if payment is delayed beyond the deadline.

- Fill in the payment method section. Select whether you will pay via credit card, debit card, or e-check, and provide the necessary details.

- Once all information has been reviewed and completed, save any changes made to the form. You can also choose to download, print, or share the filled form for your records.

Take control of your property tax responsibilities by completing your Riverside County Property Tax Bill online today.

In California, there is no strict age at which you stop paying property taxes. However, seniors may qualify for certain exemptions or reductions that can lower their Riverside County property tax bill. It's prudent to check with local tax authorities or a knowledgeable resource to see what options may be available for seniors who own property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.