Loading

Get Boe 266 P1 Rev 12 05 14 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Boe 266 P1 Rev 12 05 14 online

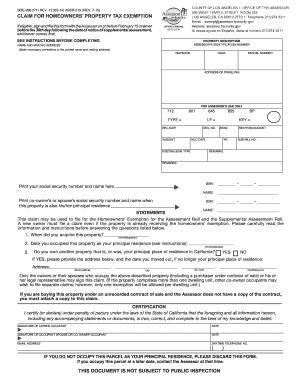

The Boe 266 P1 Rev 12 05 14 is a vital form for claiming the homeowners' property tax exemption in California. This guide provides clear, step-by-step instructions on filling out the form online, ensuring users can efficiently complete their application.

Follow the steps to fill out the Boe 266 P1 Rev 12 05 14 online smoothly.

- Press the ‘Get Form’ button to access the form and open it in an online editor.

- Enter the property description including the Assessor's Identification Number, the address of the dwelling, and any required corrections to your name and mailing address. Ensure that all information is accurate.

- Fill in your social security number and the name of any co-owner or spouse whose principal residence the property is. If applicable, provide their social security number as well.

- Complete the statements section by answering the questions regarding when you acquired and occupied the property as your principal residence.

- If you own another property that was your principal residence, check 'Yes' and provide the address and the date you moved out.

- Read through the certification statement carefully, then sign and date the form as the owner occupant. If applicable, have your spouse or co-owner occupant also sign.

- Finally, review all entries for accuracy. Once you are satisfied, save your changes, download the form for your records, or print it out to submit to the Assessor’s office.

Complete your Boe 266 P1 Rev 12 05 14 form online today to ensure you claim your homeowners' property tax exemption promptly.

Filing a homestead declaration in California requires completing the necessary forms that declare your primary residence. This process can provide additional protections against creditors. To help in this process, utilizing the Boe 266 P1 Rev 12 05 14 can be a great resource, ensuring you file correctly and on time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.