Loading

Get Nyc 210 Form 2019 Pdf 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc 210 Form 2019 Pdf online

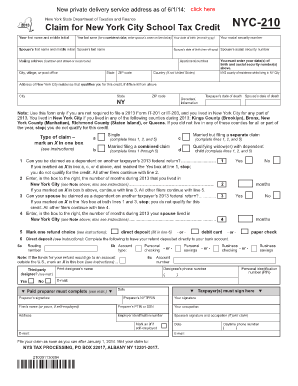

Filling out the Nyc 210 Form 2019 Pdf is a crucial step in claiming your New York City School Tax Credit. This comprehensive guide provides step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the Nyc 210 Form 2019 Pdf online.

- Click the ‘Get Form’ button to obtain the Nyc 210 Form and open it in the online editor.

- Begin filling out the form by providing your first name and middle initial, last name, and date of birth in the designated fields.

- If applicable, enter your spouse's first name and middle initial, last name, date of birth, and social security number in the appropriate sections.

- Complete the mailing address section, providing your number and street, apartment number, city, state, ZIP code, and country if applicable.

- Fill in your social security number and specify your NYS county of residence while living in New York City.

- If your address of residence that qualifies you for the credit differs from the mailing address, enter it in the provided space.

- Mark the box that corresponds to your type of claim: single, married but filing separately, married filing combined, or qualifying widow(er) with dependent child.

- Answer the questions related to dependency status and the number of months you lived in New York City during 2013 as instructed on the form.

- Select your refund choice and complete any required banking information for direct deposit if applicable.

- Lastly, ensure both you and your spouse (if applicable) sign the form, and include any necessary preparer information before saving.

Complete your forms online for an efficient and hassle-free process.

To mail your federal tax return in New York, you will need to reference the IRS guidelines specific to your situation, including your filing status and the forms you are submitting. Addresses for mailing vary depending on whether you are including a payment or not. Always check the necessary details on the IRS website or on the forms provided, as well as in the NYC 210 Form 2019 Pdf for integrated filing tips.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.