Loading

Get Fsa Form 931c 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fsa Form 931c online

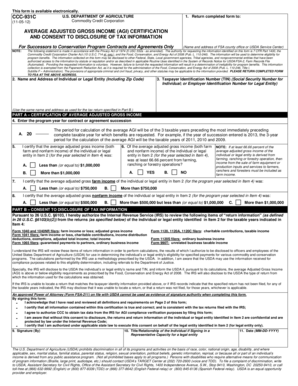

Filling out the Fsa Form 931c online is an essential step for individuals and legal entities seeking to certify their average adjusted gross income for various USDA programs. This guide will lead you through each section of the form, providing clear instructions to ensure a smooth submission process.

Follow the steps to complete and submit your form online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Enter the name and address of the FSA county office or USDA Service Center where you will return the completed form.

- In the Name and Address field, input the name and address of the individual or legal entity as it appears on the IRS tax returns for the applicable years.

- Provide the Taxpayer Identification Number (TIN), which can be either a Social Security Number for individuals or an Employer Identification Number for legal entities.

- Specify the Program Year for which you are requesting benefits, as this will determine the three-year period used for calculating average adjusted gross income.

- Select the appropriate box for your average adjusted gross income from the options provided, ensuring to choose only one response.

- Indicate whether at least 66.66 percent of your average adjusted gross income was derived from farming, ranching, or forestry operations by selecting 'YES' or 'NO'.

- Choose the correct option that reflects your average adjusted gross farm income for the three-year period related to the selected program year.

- Select the box that represents your average adjusted gross nonfarm income for the same period.

- Read the acknowledgments carefully, affix your signature, and indicate your title or relationship if signing on behalf of a legal entity.

- Enter the date on which you are signing the form using the prescribed format (MM-DD-YYYY).

- Once all fields are completed, save your changes, and choose to download, print, or share the form as needed.

Complete your Fsa Form 931c online today to ensure compliance and eligibility for program benefits.

To receive approval for using FSA funds, you must submit the FSA Form 931c along with your expenses to your benefits administrator. Make sure that your claims comply with the guidelines established by your employer’s plan to ensure smooth processing. By accurately completing the required forms, you streamline the path to getting FSA approval.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.