Loading

Get A 1 131 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A-1-131 online

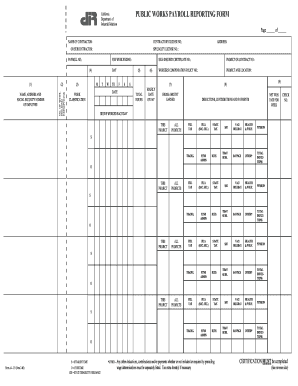

Filling out the A-1-131 form is essential for accurate payroll reporting in compliance with California's Department of Industrial Relations. This guide will provide a clear, step-by-step approach to ensure that you successfully complete the form online.

Follow the steps to accurately complete the A-1-131 form.

- Press the ‘Get Form’ button to access the A-1-131 form and open it in your preferred online editor.

- Begin with the name and contact details by entering the name of the contractor, the contractor's license number, and the payroll number for the reporting period. Ensure accuracy to avoid discrepancies.

- For each employee, fill in their name, address, and social security number in the specified fields. Ensure that this information is up to date and correctly formatted.

- Indicate the number of withholding exemptions for each employee to ensure correct tax deductions are made.

- In the work classification section, enter the employee's role or type of work performed during the pay period. This categorization is essential for reporting requirements.

- Document the total hours worked by each employee throughout the week, showing daily hours for Monday through Sunday.

- Enter the hourly rate of pay for each employee listed in the form. Check that the rate aligns with applicable wage determinations.

- Calculate and list the gross amount earned by each employee during the week based on the total hours worked and the hourly rate.

- Detail all deductions and contributions for each employee, including federal taxes, state taxes, and any specific deductions relevant to your payroll practices.

- Include any additional contributions or payments under the 'Other' section. Ensure to provide a detailed breakdown if necessary.

- Complete the certification section at the end of the form. The authorized individual must sign and date the document, verifying the accuracy of the payroll records submitted.

- Review the form for accuracy. Once complete, save your changes, and proceed to download or print the form for your records or submission as required.

Complete your payroll report online today to ensure compliance and streamline your reporting process.

The processing time for Form I-131 varies based on individual circumstances and current USCIS workloads. Typically, it can take anywhere from a few months to longer. By staying updated through the USCIS website and utilizing tools from platforms like US Legal Forms, you can get a clearer picture of the possible timeframes for your A 1 131 application.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.