Loading

Get Forms$challanitns-280.rtf - Incometaxindia Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Forms$challanitns-280.rtf - Incometaxindia Gov online

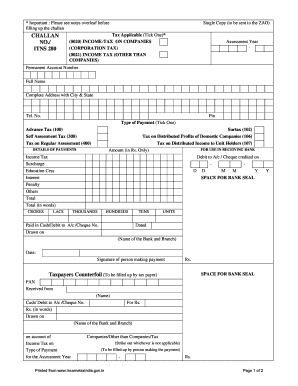

This guide provides detailed instructions on completing the Forms$challanitns-280.rtf required for income tax payments in India. By following these steps, you will ensure that your submission is accurate and complete.

Follow the steps to fill out the Form 280 successfully.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Select the applicable tax category by ticking the appropriate box: either 'Income-tax on companies' (0020) or 'Income tax (other than companies)' (0021).

- Enter the assessment year in the designated space next to 'Assessment Year'.

- Fill in your Permanent Account Number (PAN) in the specified field, alongside your full name and complete address, including city and state.

- Provide your telephone number and PIN code in the respective fields.

- Choose the type of payment by ticking one of the options: 'Advance Tax' (100), 'Surtax' (102), 'Self Assessment Tax' (300), 'Tax on Regular Assessment' (400), 'Tax on Distributed Profits of Domestic Companies' (106), or 'Tax on Distributed Income to Unit Holders' (107).

- In the 'Details of Payments' section, enter the amounts for Income Tax, Surcharge, Education Cess, Interest, Penalty, and others as applicable.

- Calculate and fill in the total amount to pay at the end of the payment details section.

- Indicate the method of payment by providing the details of whether it is paid in cash, deducted from the account, or through a cheque. If paying via cheque, include the cheque number and the date.

- Make sure to sign the document at the provided space, affirming the correctness of the information entered.

- Review all entries for accuracy, ensuring that all required fields are complete, and any applicable notes from the document are adhered to.

- Finally, save your changes, and consider downloading, printing, or sharing the form as needed.

Complete your tax payment forms online to ensure timely submissions and compliance.

Related links form

An example of TDS is salary payments, where the employer deducts tax before the employee receives their paycheck. This method ensures that tax is collected right at the source, helping both taxpayers and authorities. Understanding how TDS works helps you manage your finances better and comply with tax laws. Knowing examples strengthens your grasp of tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.