Get Erfc Direct 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Erfc Direct online

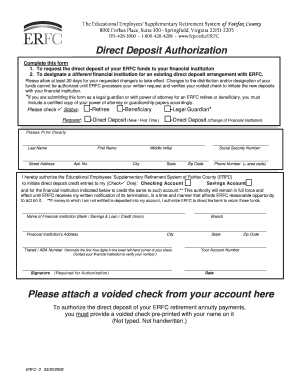

Filling out the Erfc Direct form is an essential step for users who wish to set up or change their direct deposit arrangements with the Educational Employees’ Supplementary Retirement System of Fairfax County. This guide will provide clear and concise instructions to ensure a smooth submission process.

Follow the steps to successfully complete the Erfc Direct form online.

- Click the ‘Get Form’ button to obtain the form, making it accessible for your completion.

- Indicate your status by selecting either 'Retiree' or 'Beneficiary.' Ensure to mark 'Legal Guardian' if applicable.

- Select 'Direct Deposit (New/First Time)' or 'Direct Deposit (Change of Financial Institution)' based on your request.

- Fill in your last name, first name, and middle initial in the provided fields, ensuring clarity and accuracy.

- Enter your social security number to properly identify your records.

- Provide your residential address, including street address, apartment number (if applicable), city, state, and zip code.

- Include your phone number with the area code for any future communication regarding your submission.

- Authorize the direct deposit by indicating whether it is to a checking or savings account.

- Clearly print the name of your financial institution, its branch, and address.

- Input the transit/ABA number, which can generally be found in the lower left corner of your check.

- Provide your account number as confirmed by your financial institution.

- Sign and date the form in the specified fields to confirm your authorization.

- Attach a voided check that includes your name. This check must be pre-printed, as handwritten or typed checks are not accepted.

- Review all information for accuracy before submitting your completed form.

- After finalizing your edits, save your changes and either download, print, or share the completed form as required.

Complete your Erfc Direct form online today to ensure timely changes to your direct deposit arrangements.

The Educational Employees Supplemental Retirement System of Fairfax County is a retirement plan designed to provide additional savings for educational employees. This system complements ERFC by offering extra benefits that enhance retirement security. Understanding this supplemental system is important when planning for your future, and ERFC Direct can help you explore your options.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.