Get Labor Rate Worksheet 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LABOR RATE WORKSHEET online

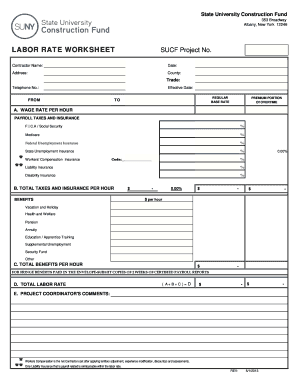

The LABOR RATE WORKSHEET is an essential document for construction contractors, enabling them to present labor rate details accurately and efficiently. This guide will help you navigate the form online and ensure all necessary fields are completed correctly.

Follow the steps to fill out the LABOR RATE WORKSHEET correctly.

- Click ‘Get Form’ button to obtain the LABOR RATE WORKSHEET and open it in your preferred editor.

- Enter the SUCF Project Number at the top of the form. This information helps identify the specific project you are working on.

- Fill in the contractor's name, date, address, county, trade, and telephone number. Make sure all contact information is accurate.

- Specify the effective date of the labor rates being recorded. This date should reflect when the rates will start applying.

- In the 'Regular Base Rate' section, specify the wage rate per hour alongside any payroll taxes and insurance such as F.I.C.A, Medicare, federal and state unemployment insurance, and both liability and workers' compensation insurance. Enter the applicable percentages for each insurance type.

- Calculate the total taxes and insurance per hour and record it in section B.

- Provide detailed information on benefits in section C, including values for vacation and holiday pay, health and welfare contributions, pension plans, annuities, education/apprentice training, and any supplemental unemployment security funds.

- Sum up all sections to calculate the total labor rate (A + B + C) and write it in section D.

- In the comments section, E, if necessary, provide any additional insights or notes that may assist in understanding the rates or calculations.

- After completing the form, save your changes, and then choose to download, print, or share the LABOR RATE WORKSHEET as needed.

Start competing documents online now for efficient labor rate management.

Related links form

To calculate labor rate variance, determine the difference between the actual labor rate and the standard labor rate, and then multiply by the hours worked. This can highlight discrepancies between what you budgeted and what you are spending. A LABOR RATE WORKSHEET is essential for visualizing and understanding this data.

Fill LABOR RATE WORKSHEET

These are the labor rates that should be used on all change order requests when labor hours are broken out. The rate sheet must be signed. 5. Labor Rate Breakdown Worksheet. KU Project Number: Date: Labor Rate Classification: Base Hourly Rate Actually Paid to Employee. No information is available for this page. DTI Labour Rate Worksheet. Contractor's performing work for the DTI Buildings Division Design and Construction Group is expected to complete and submit. Contractor Labor and Material Worksheet - Form III.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.