Loading

Get Kontoopplysninger 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kontoopplysninger online

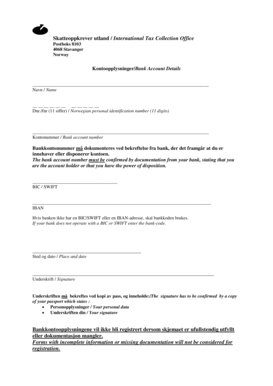

The Kontoopplysninger form is essential for providing your bank account details to the International Tax Collection Office. This guide will walk you through each section of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to successfully complete the Kontoopplysninger form.

- Press the ‘Get Form’ button to access the Kontoopplysninger form and open it in your preferred editing environment.

- In the 'Navn / Name' section, enter your full name as it appears on your official documents.

- Next, fill in your Dnr./fnr (Norwegian personal identification number) with an 11-digit number.

- Proceed to the 'Kontonummer / Bank account number' field. Ensure that this number is accompanied by documentation from your bank confirming you as the account holder or that you have authority over the account.

- In the 'BIC / SWIFT' section, provide the corresponding code for your bank. If your bank does not have a BIC or SWIFT code, use the designated bank code instead.

- Fill in the 'IBAN' field. This is a standard international bank account number that identifies your account across borders.

- Complete the 'Sted og dato / Place and date' field with the current location and the date of filling out the form.

- Sign the form in the 'Underskrift / Signature' section. Remember, your signature must be verified with a copy of your passport, which must include your personal information and signature.

- Before submitting the form, review your entries carefully to ensure no fields are left blank and that all necessary documentation is attached.

- Once completed, you may save your changes, download the form, print it for your records, or share it as required.

Complete your Kontoopplysninger form online today for a smooth and efficient process.

Filling out foreign income on tax forms involves detailing income received from overseas sources. Begin by converting foreign income into your local currency and then report it accurately on your form. Ensure your Kontoopplysninger reflect all necessary income sources to maintain compliance and accuracy in reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.