Loading

Get (form I.r.163a) 2014 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the (Form I.R.163A) 2014 online

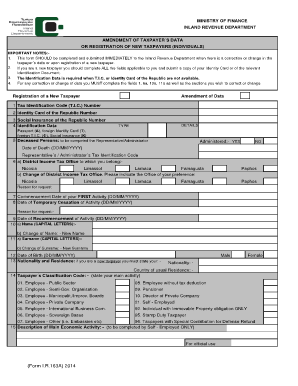

Filling out the (Form I.R.163A) 2014 online is an essential process for correcting taxpayer data or registering new taxpayers. This guide aims to provide clear, step-by-step instructions tailored to meet various user needs, ensuring a straightforward experience.

Follow the steps to successfully complete the form online.

- Click 'Get Form' button to access the form and open it in the editor.

- Begin filling out the form by entering your Tax Identification Code (T.I.C.) number in section 1. If you are a new taxpayer, also provide your Identity Card number in section 2.

- Fill in your Social Insurance number in section 3 along with any relevant Identification Data if your T.I.C. or Identity Card is not available.

- For deceased persons, complete the Representative/Administrator section and provide the date of death in section 5, as well as the representative’s T.I.C.

- In section 6a, select your District Income Tax Office. If you wish to change your office, indicate your preference in section 6b and provide the reason for the request.

- Enter the commencement date of your first activity in section 7, along with any temporary cessation and recommencement dates in sections 8 and 9.

- In section 10, provide your name in capital letters. If applicable, indicate any change of name in section 10b.

- Fill out your surname in section 11, ensuring it is in capital letters. Note any changes in surname in section 11b.

- Complete section 12 with your date of birth, followed by your nationality and residence in section 13.

- Determine your taxpayer classification in section 14 by selecting the code that best describes your main activity.

- If applicable, describe your main economic activity in section 15.

- Select your marital status in section 16, and provide your spouse's Identity Card number or T.I.C. if relevant.

- Include details of your first/new representative in section 17 and indicate if current representation is being terminated.

- State whether you prepare audited accounts in section 18, and provide the details of your accountant/auditor in section 19.

- In section 20, provide commencement/recommencement and termination dates as an employer, along with the number of employees.

- Select your communication language in section 21 and input your home address in section 22.

- If your business address is different, fill in section 23 with your business address details.

- Complete section 24 with your correspondence address if you select 'other' and ensure all fields are filled in for postal correspondence.

- Review the declaration statement at the end of the form, affirming the accuracy of the information provided.

- After ensuring that all sections are complete and correct, save your changes, download, print, or share the form as necessary.

Begin filling out your documents online today to ensure timely submission and compliance.

To download Form 26AS, log into the income tax portal and navigate to the 'My Account' section. Select the option for Form 26AS, and follow the prompts to download the PDF. This simple process is vital when utilizing Form I.R.163A) 2014 for your tax filings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.