Get Form 14653 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 14653 online

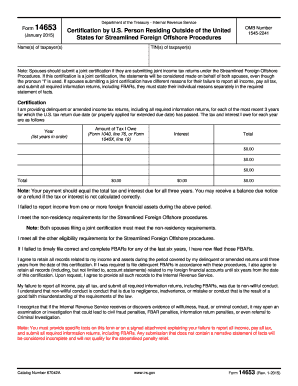

Filling out Form 14653 is an important step for individuals who are U.S. taxpayers residing outside of the United States and seeking to participate in the streamlined foreign offshore procedures. This guide will walk you through the necessary steps to accurately complete and submit the form online.

Follow the steps to successfully complete the Form 14653 online.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Begin by entering the name(s) of the taxpayer(s) in the designated field at the top of the form. Ensure you provide accurate and complete information.

- Input the Tax Identification Number(s) (TIN) of the taxpayer(s). This is a crucial part of the form, as it identifies you to the IRS.

- If you are submitting this as a joint certification with a spouse, make sure to indicate that by following the instructions for joint certifications as outlined in the form.

- Provide delinquent or amended income tax returns for the last three years where the U.S. tax return due date has passed. Specify each year and the corresponding amounts of tax owed, interest, and total amounts due.

- Complete the certification section, affirming that you have failed to report income from foreign financial assets and meet the non-residency and eligibility requirements outlined.

- In the narrative section, provide specific reasons for your failure to report income, pay tax, and submit information returns. Include details about any professional advice obtained, if applicable.

- Sign the form electronically. Each taxpayer, and a spouse if applicable, must sign and date the form at the designated sections.

- Once all information is entered and verified, you can save the changes, download a copy for your records, print the form, or share it as necessary.

Complete your Form 14653 online today to ensure compliance with IRS regulations.

Form 8938, Statement of Specified Foreign Financial Assets, is required for individuals living outside the US who have specified foreign financial assets that exceed certain thresholds. This form is essential for reporting foreign investments and accounts to the IRS. If you find it challenging to navigate, USLegalForms can help simplify the form-filling experience and ensure accuracy in your reports.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.