Get Tiaa Forms F11379 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tiaa Forms F11379 online

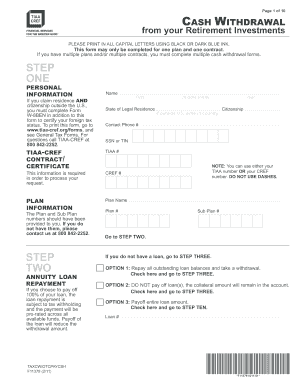

Filling out the Tiaa Forms F11379 online is a crucial step for those looking to manage cash withdrawals from their retirement investments. This guide provides clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Tiaa Forms F11379 online.

- Click the ‘Get Form’ button to access the Tiaa Forms F11379 and open it in the online editor.

- Enter your personal information in the designated fields, including your name, state of legal residence, contact phone number, and taxpayer identification number.

- If applicable, provide information regarding any annuity loan repayment, indicating whether you choose to pay off your loan or opt to leave the collateral amount in place.

- Indicate if you have Roth accumulations and specify the type of withdrawal you are requesting, ensuring clarity on whether you want non-Roth, Roth, or both types.

- Complete the tax withholding section, choosing the appropriate withholding options for your withdrawal, taking care to understand the implications based on your account type.

- Decide on the amount you wish to withdraw, whether in full or as a partial distribution, and provide the necessary details in the corresponding fields.

- If requesting systematic withdrawals, specify the frequency of withdrawals and the starting date as per your preference.

- Select your delivery instructions, choosing between direct deposit into your checking or savings account, and remember to attach a voided check or corresponding bank letter.

- Sign and date the form in the designated section to authorize the withdrawal request and confirm your personal account information.

- If applicable, ensure that your spouse's waiver is completed with their signature and notarization, and include all necessary documents.

- Seek signature from the plan representative if required, to finalize the form according to the employer's plan provisions.

- Review the completed form and ensure that all sections are filled out correctly before submitting.

- Return the completed forms package to the provided mailing addresses, ensuring the inclusion of all documents for processing.

Complete your cash withdrawal request online efficiently using the Tiaa Forms F11379.

Distributions from investment accounts, like TIAA, are usually taxed based on the type of account and the investment's nature. For traditional accounts, for example, your distributions are typically taxed as ordinary income. TIAA Forms F11379 can provide valuable insights into the tax treatment applicable to your distributions, helping you prepare for tax season. Always consider consulting a tax advisor for tailored advice.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.