Get Irs Notice B Blank Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Notice B Blank Form online

Successfully completing the Irs Notice B Blank Form is essential for maintaining accurate records and complying with federal requirements. This guide provides clear and supportive instructions on how to fill out the form online, ensuring that users understand each section and can complete the process with confidence.

Follow the steps to complete the form accurately and efficiently.

- Click the ‘Get Form’ button to obtain the form and open it in the editor for online editing.

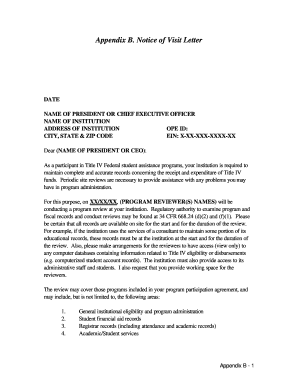

- Begin by entering the date at the top of the form to indicate when the document is being filled out.

- Fill in the name of the president or chief executive officer as required, making sure to use the correct spelling and title.

- Provide the name of the institution that the form pertains to, ensuring that it matches the official institution name.

- Complete the address section, including the institution's street address, city, state, and ZIP code to ensure accurate delivery.

- Enter the OPE ID, which is a unique identifier assigned to the institution, followed by the EIN in the specified format.

- Draft a greeting, addressing the letter to the president or CEO, which will personalize the document.

- Proceed to provide comprehensive details regarding the purpose of the form, including requirements for record maintenance and access during the review process.

- Outline specific records that need to be made available for the reviewers, as listed in the form, ensuring all necessary documentation is included.

- At the bottom of the form, ensure to provide contact information for both the reviewer and the institution in case of inquiries.

- After confirming all information is accurate, save your changes, and choose to download, print, or share the completed form as required.

Start completing your documents online to ensure effective management and compliance.

The 4506 B form is an IRS document that allows taxpayers to authorize the IRS to disclose certain information to third parties. It is commonly used by lenders or other institutions when verifying income information. If you receive a B notice, it may be helpful to reference the Irs Notice B Blank Form to ensure all necessary documentation is correctly filed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.