Get Life Insurance Replacement Declaration

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Life Insurance Replacement Declaration online

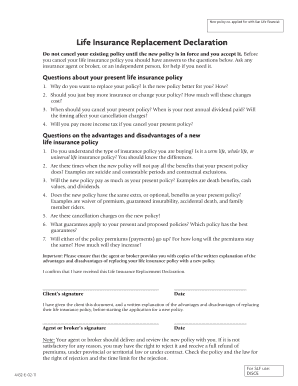

The Life Insurance Replacement Declaration is an important document that assists individuals in understanding the implications of replacing their current life insurance policy. This guide provides a clear, step-by-step approach to filling out the form online, ensuring that users can navigate the process confidently and effectively.

Follow the steps to complete your Life Insurance Replacement Declaration online.

- Click ‘Get Form’ button to access the form and open it in your preferred online format.

- Begin by reviewing the first section, which relates to your current life insurance policy. Answer the question about why you want to replace your policy and consider how the new policy may better serve your needs.

- Consider whether it might be more beneficial for you to increase your current policy coverage rather than switch to a new policy. Assess the costs involved in making these changes.

- Next, determine the right timing for canceling your current policy. Take note of your annual dividend payment schedule and how this affects potential cancellation charges.

- Evaluate potential tax implications of canceling your existing policy to ensure you are making an informed decision.

- In the advantages and disadvantages section, review the type of new insurance policy you are applying for. Clarify whether it is term life, whole life, or universal life insurance, and understand the distinctions.

- Consider whether the new policy provides coverage for all the benefits you might have under your current policy. Pay attention to specific exclusions that could affect your coverage.

- Investigate if the new policy offers comparable death benefits, cash values, and dividends as your current policy.

- Check for any optional benefits included in the new policy and compare these to those in your current policy.

- Review any cancellation charges associated with the new policy to understand your potential financial commitments.

- Compare the guarantees of both policies and determine which offers the best security for your needs.

- Lastly, note any potential premium increases for either policy and how long the premiums are expected to remain stable. Record any anticipated increases.

- Once you have completed the form, ensure you sign and date where indicated. After finalizing your entries, you can save your changes, download, print, or share the completed document as needed.

Complete your Life Insurance Replacement Declaration online today for a smoother insurance transition.

The written explanation of the life insurance replacement declaration clarifies the implications of replacing a life insurance policy. It outlines the reasons for replacement, potential benefits, and risks involved. Thoroughly reviewing this declaration is essential to make informed decisions about your financial future.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.