Get Should You Participate In The Variable Trust Fund Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Should You Participate In The Variable Trust Fund Form online

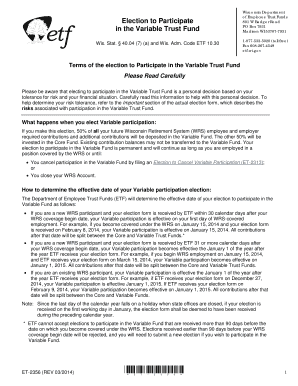

Filling out the Should You Participate In The Variable Trust Fund Form is an important step in managing your retirement benefits. This guide provides clear and comprehensive instructions to ensure that users can complete the form easily and accurately online, regardless of their previous experience with legal documents.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- Begin by entering your employer's name in the designated field. This helps identify your employment affiliation.

- Provide your Social Security number. Ensure this number is entered correctly, as it is crucial for your retirement account.

- Fill in your last name, followed by your first name and middle initial. Accuracy in personal information is important.

- Input your address, including street, city, state, and ZIP code to establish your residence details.

- Enter your birth date in the format MM/DD/CCYY. This information is used for identification and eligibility purposes.

- Read the terms of participation carefully. Acknowledge your understanding by checking the appropriate box in the form.

- Sign and date the form in the specified fields to certify that the information you provided is accurate.

- Provide a daytime telephone number where you can be reached if there are questions regarding your submission.

- Make a copy of the completed form for your records, then submit the original to the Department of Employee Trust Funds at the address provided.

- Once submitted, ensure to await the acknowledgement letter from the ETF confirming your election.

Complete your documents online to secure your Variable Trust Fund participation!

A variable trust is a trust designed to provide more flexibility in terms of investment choices and asset management. Unlike traditional trusts, a variable trust can adjust its investments based on performance and market conditions. This can lead to potentially higher returns, although it also comes with increased risks. If you're contemplating, 'Should You Participate In The Variable Trust Fund Form,' understanding variable trusts can provide valuable insights into your potential investment strategy.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.