Loading

Get Mw507 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MW507 online

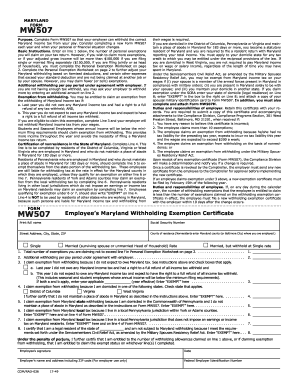

Completing the MW507 form is essential for ensuring your employer withholds the correct Maryland income tax from your paycheck. This guide will walk you through each section of the form to make filling it out easier for you.

Follow the steps to successfully complete the MW507 form online

- Press the ‘Get Form’ button to obtain the MW507 form and open it in the editor.

- Provide your full name in the designated field at the top of the form.

- Enter your Social Security Number in the specified field to ensure correct identification.

- Fill in your street address, city, state, and ZIP code.

- Indicate your county of residence. If you are a nonresident, please enter the Maryland county (or Baltimore City) where you are employed.

- Choose your filing status: Single, Married (or Head of Household), or Married but withholding at the Single rate.

- On line 1, enter the total number of exemptions you are claiming, as per the Personal Exemption Worksheet on page 2.

- If you wish to withhold additional amounts, input that figure in line 2.

- Line 3 allows you to claim exemption from withholding if you meet certain criteria. Review the instructions carefully and check the appropriate boxes that apply.

- For nonresidence claims, complete lines 4 through 7 as applicable to your situation based on your state of domicile.

- If claiming exemption under the Servicemembers Civil Relief Act, fill in line 8 with your state of domicile and attach the required documents.

- Review the entire form, ensuring all fields are completed accurately.

- Sign and date the form at the bottom to certify the information provided is correct.

- Once completed, you can save your changes, download, print, or share the form as needed.

Get started on completing your MW507 online today!

Related links form

The $3200 exemption in Maryland pertains to the allowance for claims on the MW507 form. Taxpayers may be eligible to reduce their taxable income by this amount for each exemption claimed. This can significantly lower your overall state tax liability, so understanding your eligibility is essential for effective tax management.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.