Loading

Get Mortgage Processing Checklist Form 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Processing Checklist Form online

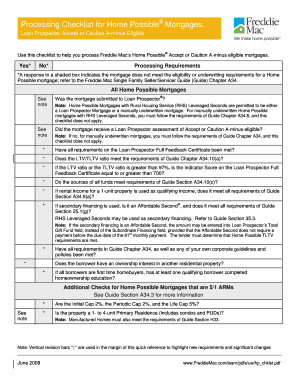

The Mortgage Processing Checklist Form is an essential tool for ensuring that Freddie Mac’s Home Possible® mortgages meet eligibility and underwriting requirements. This guide provides clear, step-by-step instructions on how to complete the form online, making the process easier and more efficient for users with varying levels of experience.

Follow the steps to complete the form efficiently.

- Press the ‘Get Form’ button to acquire the Mortgage Processing Checklist Form and open it in your online editor.

- Carefully read the introductory section to understand the purpose and requirements outlined in the form.

- In the first section, determine whether the mortgage was submitted to Loan Prospector. Mark 'Yes' or 'No' accordingly.

- Next, indicate if the mortgage received a Loan Prospector assessment of Accept or Caution A-minus eligible by selecting the appropriate checkbox.

- Review the requirements listed on the Loan Prospector Full Feedback Certificate and ensure all have been fulfilled; denote 'Yes' or 'No' as applicable.

- Check the LTV/TLTV ratio against the requirements of Guide Chapter A34.10(a) and answer appropriately.

- If the LTV or TLTV ratio exceeds 97%, confirm whether the Indicator Score on the Loan Prospector Full Feedback Certificate meets the required threshold of 700.

- Verify that the sources of all funds comply with Guide Section A34.10(c) and record your answer.

- If rental income is considered for a 1-unit property, ensure it meets the requirements of Guide Section A34.9(a), and answer accordingly.

- If secondary financing is involved, confirm it is an Affordable Second® and complies with Guide Section 25.1(g). Answer 'Yes' or 'No' as needed.

- Evaluate if all requirements in Guide Chapter A34, as well as your corporate guidelines, have been satisfied.

- Determine if the borrower holds an ownership interest in another residential property and respond appropriately.

- If all borrowers are first-time homebuyers, confirm that at least one qualifying borrower has completed homeownership education.

- For mortgages that involve additional checks, ensure that the initial cap rates and property type requirements are met, and answer the related questions.

- Finally, review all sections for completeness, save your changes, and choose to download, print, or share the completed form as needed.

Complete your Mortgage Processing Checklist Form online today to streamline your mortgage application process.

Lender processing is when a mortgage lender processes all of the required documents and information needed to make sure the borrower qualifies for the loan they are applying for.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.