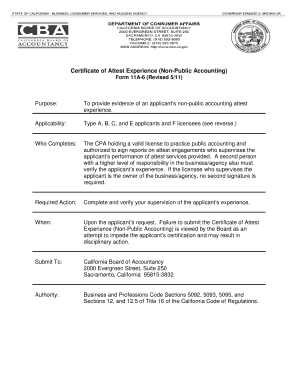

Get Certificate Of Attest Experience (non-public Accounting) - California Board Of Accountancy

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certificate Of Attest Experience (Non-Public Accounting) - California Board Of Accountancy online

This guide provides a comprehensive overview of how to fill out the Certificate Of Attest Experience (Non-Public Accounting) necessary for CPA licensure in California. By following these steps, users can ensure accurate and complete submission of their experience documentation.

Follow the steps to successfully complete your form online.

- Click ‘Get Form’ button to retrieve the form and open it in the editor.

- Begin by entering the full name of the applicant in the designated fields. Ensure not to use initials.

- Input the last four digits of the applicant's social security number in the appropriate section.

- Document the period of employment in the specified fields by recording the start and end dates under full-time or part-time sections.

- Provide the total part-time hours worked during the specified experience period.

- Respond to the qualifying experience questions listed in the format of 'Yes' or 'No', ensuring to provide an assessment of the applicant’s understanding and application of audit procedures.

- Complete the summary of attest experience hours, carefully detailing the hours related to audit, review, and other attest services.

- Fill in the area indicating any relationship between the applicant and anyone in the firm.

- Complete the employer's details, including name, business telephone, and address.

- Both supervisors must sign the form. The first supervisor should include their license details, and if applicable, the second supervisor with higher-level responsibility must sign as well.

- After thoroughly reviewing the completed form for accuracy, save your changes, download a copy for your records, and ensure it is sent to the California Board Of Accountancy.

Ensure to complete the Certificate Of Attest Experience online to facilitate your CPA licensure application process.

Get form

Related links form

A CPA attestation refers to the process where a CPA reviews financial statements and confirms their accuracy and compliance with regulations. This service is critical for businesses, as it adds credibility to their financial reports. If you are working towards a Certificate Of Attest Experience (Non-Public Accounting) - California Board Of Accountancy, understanding attestation services will strengthen your expertise. Consider uslegalforms to find more information on this essential service.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.