Loading

Get Payroll Maxx Forms 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payroll Maxx Forms online

This guide provides step-by-step instructions to help you complete the Payroll Maxx Forms online efficiently and correctly. Whether you are setting up direct deposit for the first time or making changes to existing details, this guide is designed to support you through the process.

Follow the steps to accurately fill out the Payroll Maxx Forms.

- Press the ‘Get Form’ button to access the Payroll Maxx Forms and open them in your chosen editor.

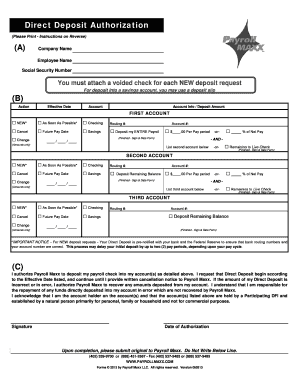

- In section (A), print your company name and your name at the top of the form.

- In the 'Action' section, select the appropriate option: NEW, Cancel, or Change based on your request.

- Specify the 'Effective Date' option, choosing either 'As Soon As Possible' or 'Future Pay Date' as needed.

- Indicate the type of account by checking the corresponding box for Checking or Savings.

- In the 'Account Info' section, carefully print the Routing Number and Account Number. Remember to attach a voided check for each new account or a deposit slip for savings accounts.

- Decide how much of your payroll should be deposited in this account. You can select 'Deposit my ENTIRE Payroll,' specify a dollar amount per pay period, or indicate a percentage of net pay.

- If you wish to list a second account, fill out the details in the 'SECOND ACCOUNT' section, repeating the process for any additional accounts.

- In section (C), read the terms carefully. Ensure that you sign and date the form to authorize Payroll Maxx to proceed.

- Attach the necessary documents and submit your completed original form to Payroll Maxx, either by hand or via mail.

Complete your Payroll Maxx Forms online today to ensure your direct deposits are processed smoothly.

Asure Software, the provider behind Payroll Maxx Forms, is headquartered in Austin, Texas. This central location allows them to effectively support businesses all across the United States. They focus on creating tailored solutions for payroll systems, making your payroll management simpler and more efficient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.