Get D14 866 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the D14 866 online

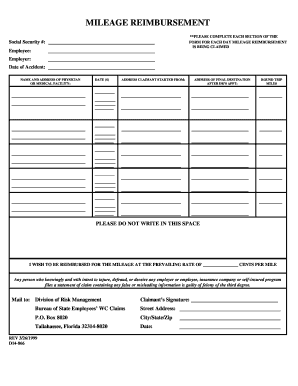

Filling out the D14 866 form for mileage reimbursement can be straightforward if you follow the right steps. This guide will provide clear instructions for each component of the form, ensuring a smooth and efficient online submission process.

Follow the steps to complete and submit the D14 866 form online.

- Press the ‘Get Form’ button to access the D14 866 form and open it in your preferred online editor.

- Enter your social security number in the designated field. Ensure this information is accurate to avoid delays.

- Fill in your name as the employee claiming mileage reimbursement. Double-check for any spelling errors.

- Provide the name of your employer in the appropriate section. This helps to identify your claims correctly.

- Input the date of the accident if applicable. This is crucial for relating the mileage claim to the event.

- In the section for the physician or medical facility, write the name and address to specify where medical services were received.

- List the dates for which you are claiming mileage. Enter each date clearly to ensure accurate processing.

- Provide the starting address from which you began your trip for the doctor’s appointment in the designated field.

- Record the address of your final destination after the doctor’s appointment. This should reflect where you traveled to.

- Calculate and enter the total round trip miles for each date. Accurate mileage is vital to ensure proper reimbursement.

- Review any notes or disclaimers in the designated space. Be sure to not write in the area marked for official use.

- Select the prevailing reimbursement rate per mile as indicated on the form. This will calculate your total claim amount.

- Sign the form in the claimant’s signature section to certifying the accuracy of your claim.

- Once all fields are completed, you can save your changes, download, print, or share the form as needed.

Complete your D14 866 form online today to ensure timely reimbursement for your mileage expenses.

Related links form

To do an expense claim, start by gathering all receipts and documentation for the expenses you want to claim. Next, complete the appropriate forms provided by your organization or use an efficient tool like D14 866 to guide you through the process. Ensure that you clearly state the purpose of each expense and review your claim for accuracy before submission. This systematic approach will help you get reimbursed quickly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.