Loading

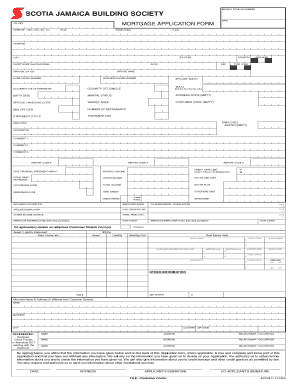

Get Mortgage Application Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Application Form online

Filling out the mortgage application form online can simplify your journey to securing a mortgage. This guide will walk you through each section of the form, ensuring you are well-equipped to complete it accurately and efficiently.

Follow the steps to successfully complete your mortgage application form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with personal information. Enter your full name, current address, and contact information. Ensure each detail is accurate as lenders will use this information to contact you.

- Provide employment details. Include your employer’s name, address, position, and length of employment. This information helps lenders assess your financial stability.

- Disclose your financial information. List your income sources, monthly expenses, and any outstanding debts. Clear and precise numbers will facilitate the assessment of your financial health.

- Select the loan details. Indicate the type of loan you are applying for, the amount you wish to borrow, and the desired term. Make informed choices based on your financial situation.

- Review your application thoroughly. Check that all fields are completed accurately and that no crucial information is missing. This step is vital to prevent delays.

- Once satisfied, save your changes. You can also download, print, or share the form for your records or further review.

Start filling out your mortgage application form online today!

To write $100.50 on a check, write 'One hundred and 50/100' on the line provided. In the box, input '100.50' next to the dollar sign. This ensures clarity and prevents confusion. For those who manage multiple payments, the Mortgage Application Form can assist in organizing your checks effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.