Get What Does An Ss 4 Form Look Like 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Does An SS-4 Form Look Like online

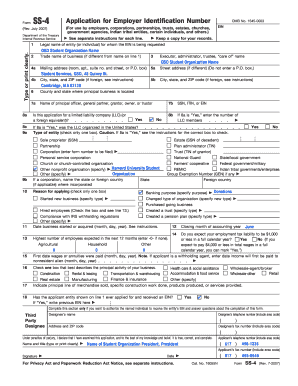

Completing the SS-4 form is essential for obtaining an Employer Identification Number (EIN) from the IRS. This step-by-step guide offers clear instructions to ensure users can accurately fill out the form online, making the process seamless and straightforward.

Follow the steps to successfully fill out the SS-4 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the legal name of the entity or individual requesting the EIN in line 1. This name should match the official documents.

- If applicable, provide the trade name of the business in line 2. This is the name the business is commonly known by, if different from the legal name.

- On line 3, include the name of the executor, administrator, trustee, or 'care of' name, if applicable.

- Complete lines 4a and 4b with the mailing address, including room, apartment, suite number, street, and city, state, and ZIP code.

- If the street address differs from the mailing address, enter it in line 5a, along with the city, state, and ZIP code in line 5b.

- Line 6 requires the name of the principal officer, general partner, grantor, owner, or trustor.

- In line 8a, indicate whether the application is for a limited liability company (LLC) and provide the SSN, ITIN, or EIN as required.

- On lines 9 and 10, specify the county and state where the principal business is located, and check the box that corresponds to the type of entity.

- Complete line 11 by checking the reason for applying for an EIN, and provide additional details if necessary.

- Fill out lines 12 to 18 regarding the business start date, accounting year, estimated employee counts, and principal business activity.

- If a third party will be handling the EIN applications, complete the Third Party Designee section with their details.

- Finally, enter the name, title, and signature of the applicant, including the date, and ensure that all information is correct before submitting.

Start completing your SS-4 form online today to obtain your EIN and manage your business effectively.

To find your Employer Identification Number (EIN), start by checking your previous tax returns or any IRS correspondence you may have received. You can also look for your EIN on Form SS-4, as it is the application form where the number is assigned. If you cannot locate it through these documents, consider using the IRS Business & Specialty Tax Line, where representatives can assist you. It's essential to know what an SS-4 form looks like to help you identify where the EIN is listed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.