Loading

Get Penn Mutual Certi?cation Of Trust 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Penn Mutual Certification of Trust online

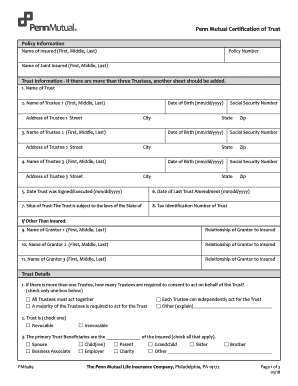

Filling out the Penn Mutual Certification of Trust online is essential for establishing the legitimacy and authority of a trust. This guide provides step-by-step instructions to ensure you accurately complete the form and provide all necessary information.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the digital editor.

- Enter the policy information, including the name of the insured and the policy number, as these details are vital for identification.

- Input the name of the joint insured, if applicable, in the provided field.

- Provide the trust information including the name of the trust. If there are more than three trustees, note that an additional sheet will be needed.

- For each trustee listed (up to three), fill in their full name, date of birth, address, and social security number in the appropriate fields.

- Indicate the date the trust was signed or executed and the date of the last trust amendment.

- Specify the situs of the trust, meaning the state under which the trust is governed.

- Input the tax identification number of the trust; ensure this number is correct.

- List any grantors related to the insured, including their names and relationship to the insured.

- Answer the questions regarding trustee consent, choosing how many trustees must act together.

- Specify whether the trust is revocable or irrevocable by selecting the appropriate box.

- Identify primary trust beneficiaries by checking all that apply from the provided options.

- Review the certifications and sign the document. Each trustee must print their name, sign, and include the date.

- After completing all sections, save changes, download, print, or share the form as required.

Complete your documents online to ensure smooth and accurate submissions.

To change your beneficiary name, first gather the required documentation, such as identification and policy details. Next, visit your insurance provider’s website or contact their support team for guidance. Companies like Penn Mutual, which are associated with the Penn Mutual Certification Of Trust, typically offer clear steps for updating your beneficiary's name without hassle.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.