Loading

Get Form N 172 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form N 172 online

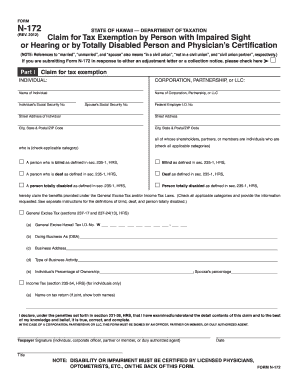

Form N 172 is a crucial document for individuals seeking tax exemptions related to vision or hearing impairments and disabilities. This guide provides clear and detailed instructions on how to effectively complete this form online, ensuring user-friendly access for all.

Follow the steps to successfully fill out Form N 172 online.

- Click the ‘Get Form’ button to obtain the form and open it in your chosen online editor.

- Begin with Part I by identifying yourself as an individual or as a corporation, partnership, or LLC. Fill in the required names, Social Security numbers, and addresses.

- Indicate if you are claiming benefits as a person who is blind, deaf, or totally disabled by checking the appropriate boxes. Ensure you select all applicable categories that relate to your situation.

- If claiming a general excise tax exemption, provide the General Excise Hawaii Tax I.D. and details about your business activities, including the Doing Business As (DBA) name and the percentage of ownership for you and your partner if applicable.

- If you are claiming an income tax exemption as an individual, fill out the section including the name(s) on the tax return.

- Ensure to sign and date the form, declaring the accuracy of the information provided, and complete the section concerning certification by a licensed physician, optometrist, or relevant professional.

- Proceed to Section A for eye examination, Section B for hearing examination, or Section C for disability report, and ensure appropriate medical professionals fill out the required details in one section only.

- Once all sections are thoroughly and accurately filled out, save your changes, and you may opt to download, print, or share the completed form online.

Complete your documents online and ensure your tax exemption claims are submitted correctly.

To track your Hawaii tax refund status, you can visit the state Department of Taxation's website. By entering your information, you can easily check where your refund stands. Keeping a copy of your submitted Form N 172 will assist in this process, making the tracking more efficient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.