Loading

Get Essential Document Locator Checklist

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Essential Document Locator Checklist online

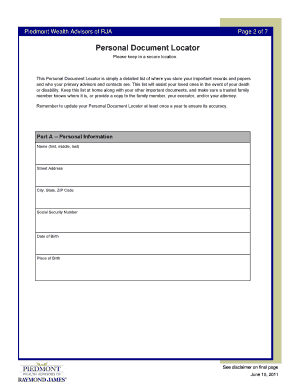

The Essential Document Locator Checklist is a vital tool for organizing important records and contacts. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring that your information is accurately documented for your loved ones.

Follow the steps to fill out your checklist effectively.

- Press the ‘Get Form’ button to access the Essential Document Locator Checklist and open it in your preferred editor.

- Begin with Part A—Personal Information. Fill in your full name, street address, city, state, ZIP code, Social Security number, date of birth, and place of birth in the designated fields.

- Move on to Part B—Personal Contacts. You will need to enter details for your attorney, tax preparer, insurance agent, and financial advisor. For each contact, provide their name, firm name, address, city, state, ZIP code, and phone number.

- Continue filling out Part B with your online accounts. Enter the website address, username, password, and any notes about each account.

- Next, in Part C—Location Key, specify where you keep your important documents. Indicate up to five locations, such as your home, office, safe, or safe-deposit box.

- Proceed to Part D—Important Documents. For each important document listed, check the corresponding number that matches the location indicated in Part C. This includes items like your will, durable power of attorney, and birth certificate.

- Once all sections are completed, review your entries for accuracy. Make necessary adjustments.

- Finally, save your changes. You can download, print, or share the completed Essential Document Locator Checklist with trusted individuals.

Take the time to complete your Essential Document Locator Checklist online today for the peace of mind it brings.

KEEP 3 TO 7 YEARS Knowing that, a good rule of thumb is to save any document that verifies information on your tax return—including Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receipts—for three to seven years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.