Loading

Get Cape Consumers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cape Consumers loan application online

This guide provides clear instructions for users on how to complete the Cape Consumers loan application form online. Designed for those with varying levels of experience, it addresses each section of the form and offers straightforward guidance.

Follow the steps to complete your loan application efficiently.

- Press the ‘Get Form’ button to access the online loan application form. This will allow you to open the document in a manageable format.

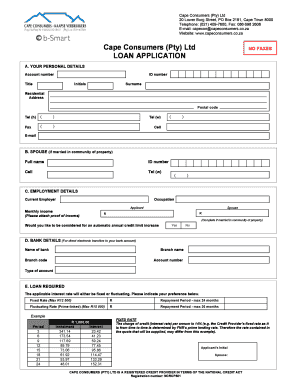

- Begin by entering your personal details in section A. This includes your account number, ID number, title, initials, surname, residential address, postal code, and contact details such as telephone numbers and email. Ensure all information is accurate and up-to-date.

- If you are married in community of property, proceed to section B to fill in your spouse's details, including their full name, ID number, cell number, and work telephone number.

- In section C, provide your employment details. Here, you will need to indicate your current employer, occupation, and monthly income. Remember to attach proof of income when prompted.

- If applicable, indicate whether you would like to be considered for an automatic annual credit limit increase.

- Section D requires your bank details for direct electronic transfers. Enter the name of your bank, branch name, branch code, account number, and type of account.

- In section E, specify the loan amount you require and whether you prefer a fixed or fluctuating interest rate. Also, indicate the desired repayment period. Be aware of the maximum limits associated with each option.

- Section F gives you the option to exclude yourself from marketing communications. Tick the appropriate boxes based on your preferences.

- Continue to section H for the affordability assessment. You will need to provide the gross monthly income and other financial commitments. This information is crucial for the assessment of your application.

- Confirm your consent for the credit provider to check your credit record(s) in section I. Sign the application and ensure that all fields have been properly completed.

- Once you have completed the form, you can save your changes, download a copy for your records, print it, or share it, as needed.

Complete your loan application online today for a streamlined experience.

Yes, buy-aid continues to operate in South Africa, extending its services to Cape Consumers in need of legal assistance. The platform helps users find funding solutions that make accessing legal resources simpler and more affordable. Whether you are looking for legal forms or representation, buy-aid remains a viable option for South African consumers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.