Loading

Get Chh New Credit Application 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CHH New Credit Application online

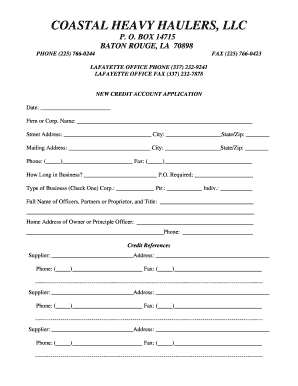

Filling out the CHH New Credit Application online is an important step for businesses seeking to establish a credit account with Coastal Heavy Haulers, LLC. This guide provides clear, step-by-step instructions to ensure you complete the application accurately and efficiently.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor for completion.

- Begin by entering the date in the designated field. Ensure this reflects the current date of your application.

- In the 'Firm or Corp. Name' field, write the complete name of your business entity, ensuring accuracy to match your legal documentation.

- Fill in the 'Street Address,' 'City,' and 'State/Zip' fields with your business's physical address.

- Complete the 'Mailing Address' section similarly, including 'City,' 'State,' and 'Zip code' for correspondence purposes.

- Provide your main phone number and fax number in their respective fields.

- Indicate how long your business has been operational in the 'How Long in Business?' field.

- If your business requires a Purchase Order (P.O.) for transactions, indicate this in the 'P.O. Required' section.

- Select the type of business entity (Corporation, Partnership, Individual) by checking the appropriate box.

- List the full names, titles, and home addresses of all officers, partners, or proprietors in the designated area.

- In the 'Credit References' section, enter the details for three suppliers, including their name, address, phone number, and fax number.

- Attach a financial statement or indicate if it will be mailed by checking the relevant box.

- Read and understand the agreement terms regarding credit, and signify your agreement by signing and printing your name in the designated signature area.

- After completing all fields, ensure all information is accurate. Save your changes, then download or print the completed form for your records. You are also able to share the form as necessary.

Complete your CHH New Credit Application online today for efficient processing.

A credit arrangement refers to the established understanding between a borrower and lender about how borrowed funds will be managed. It includes repayment schedules and any terms agreed upon. Completing a CHH New Credit Application helps in formalizing these arrangements clearly and efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.