Get W7

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

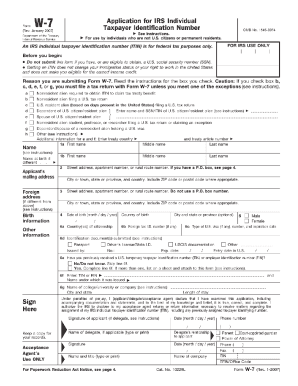

How to fill out the W7 online

Filling out the W7 form online can simplify the process of applying for an Individual Taxpayer Identification Number (ITIN). This guide provides a step-by-step approach to help users complete each section of the form with clarity and ease.

Follow the steps to fill out the W7 form efficiently.

- Click 'Get Form' button to access the W7 form and open it in your selected editor.

- Begin by filling out your name as it appears in your documents. Ensure that all provided names match the documentation you will submit.

- Provide your mailing address. This address will be used to send any correspondence related to your application.

- Fill in your foreign address, if applicable. Include details such as street address, city, province, and postal code.

- Indicate your date of birth. Use the format MM/DD/YYYY to ensure clarity and accuracy.

- Select your country of citizenship from the dropdown list. If your country is not listed, write it in the designated space.

- Select the reason for applying for an ITIN. Refer to the instructions if you are uncertain about which option applies to your situation.

- If you have been issued a federal tax form before, provide the relevant details as instructed. If not, continue to the next step.

- Sign and date the form to certify that the information you provided is accurate. Take your time to ensure this section is completed correctly.

- Once all sections are complete, you can save your changes, download the form, print a copy for your records, or share the document if necessary.

Start completing your W7 form online today to ensure a smooth application process.

Related links form

Getting a W7 involves both the preparation of your application and the IRS processing time. After you complete your application and submit it with the required documents, expect about six to eight weeks for the IRS to process your W7. This process can feel lengthy, but using platforms like US Legal Forms can give you confidence and help ensure that everything is correctly submitted from the start, potentially avoiding extra wait times.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.