Loading

Get Pa Tax Exempt Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pa Tax Exempt Form online

Filling out the Pa Tax Exempt Form online is a straightforward process that allows users to claim various tax exemptions. This guide provides clear, step-by-step instructions to help you navigate the form effectively.

Follow the steps to complete your Pa Tax Exempt Form online

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

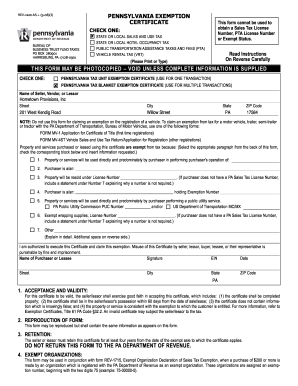

- Begin by selecting the type of exemption you are claiming from the options provided, such as state or local sales and use tax.

- Check the appropriate box to indicate whether you are using the Pennsylvania Tax Unit Exemption Certificate for a single transaction or the Pennsylvania Tax Blanket Exemption Certificate for multiple transactions.

- Fill in the information about the seller, vendor, or lessor. Include their name, street address, city, state, and ZIP code.

- Choose the reason for the exemption from the back of the form. Insert the relevant information requested, such as your Pennsylvania Sales Tax License Number if applicable.

- If applicable, provide your exemption number or the license number of the exempt wrapping supplies.

- Complete the fields for the name of purchaser or lessee, their signature, employer identification number (EIN), and the date of completion. Ensure these fields are printed clearly.

- Review the entire form for accuracy. Make any necessary corrections before finalizing.

- Once all sections are completed, you can save your changes, download, print, or share the finished form as needed.

Start completing your Pa Tax Exempt Form online today to ensure your exemption is processed efficiently.

Any business that sells taxable goods or services in Pennsylvania must register for sales tax. This includes retailers, service providers, and any entity with a nexus presence in the state. By registering, you gain access to essential resources, including the PA Tax Exempt Form for exempt sales. Proper registration is crucial for maintaining compliance with Pennsylvania tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.