Get Suntrust Napa Loan Program Financing Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SunTrust NAPA Loan Program Financing Application online

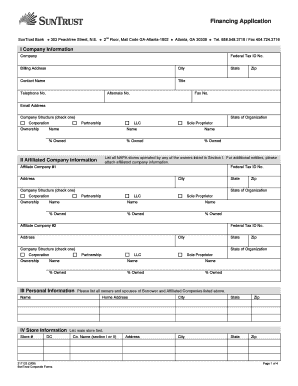

Completing the SunTrust NAPA Loan Program Financing Application online can streamline the process of securing financial support for your business. This guide will assist you in accurately filling out each section of the application form, ensuring you provide all necessary information to facilitate approval.

Follow the steps to fill out the application form correctly.

- Click ‘Get Form’ button to obtain the application and open it in the editing tool.

- Begin with Section I: Company Information. Enter the legal name of your company, Federal Tax ID Number, billing address, contact person’s name and title, and both primary and alternate telephone numbers. Ensure you select the correct company structure by checking one of the options provided.

- In Section II: Affiliated Company Information, provide details for any affiliated companies including their addresses and structures similar to Section I. List all owners and their ownership percentages clearly.

- Proceed to Section III: Personal Information. This section requires you to list all owners and partners, along with their home addresses. Include the store number and relevant information related to your main store.

- In Section IV: Store Information, enter the name and address of your store. Make sure to list the primary store first and include the associated company name.

- Fill out Section V: GPC Payment Record & References. Indicate your payment status and discount status by selecting the appropriate options.

- Section VI: Loan Request is where you specify the type of loan. Select either a line of credit or term loan, then input the total amount requested along with anticipated funding dates. Be specific about the interest rates and terms for any loans requested.

- Review all sections for accuracy. Once completed, ensure that all required signatures are provided by the owners listed in the application.

- Finally, you can save the changes made to the document, download it for your records, print a physical copy, or share it with relevant parties as needed.

Start filling out the SunTrust NAPA Loan Program Financing Application online today to expedite your loan process.

If you cannot log into your Truist account, there could be several reasons, such as an incorrect username or password. It's also possible that your account may be temporarily locked due to multiple failed attempts. You can easily resolve this issue by utilizing the account recovery options on the Truist website. If problems persist, consider visiting the US Legal Forms platform for assistance with finding contact details or forms related to Truist account recovery.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.