Loading

Get Sts 003 Nj 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sts 003 Nj online

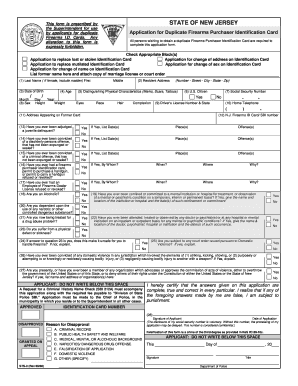

Filling out the Sts 003 Nj form for a duplicate firearms purchaser identification card can seem overwhelming. This guide will provide you with clear, step-by-step instructions to ensure the process is as straightforward as possible.

Follow the steps to complete your application accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by checking the appropriate block(s) to indicate the reason for your application, such as replacing a lost card or changing your address.

- Input your last name, first name, and middle name in the designated fields. If applicable, include your maiden name.

- Fill in your date of birth by selecting the month, day, and year accurately.

- Provide your resident address, including the number, street, city, state, and zip code.

- Enter your distinguishing physical characteristics such as height, weight, eye color, race, hair color, and complexion.

- Respond to the questions regarding your U.S. citizenship and Social Security number. Ensure that your answers are accurate.

- Input your driver's license number and state, if applicable.

- Complete the personal history section by answering questions related to past offenses, mental health, or alcohol dependency.

- Review the additional questions involving domestic violence convictions and affiliations with specific organizations.

- Certify that all provided information is complete and true by signing and dating the application.

- Once you have filled out the form fully, you can save changes, download, print, or share your completed form as needed.

Start completing your Sts 003 Nj form online today for a smooth application process.

NJ pass through entity tax is a tax levied on pass-through entities like partnerships and S corporations, calculated based on the entity's income. This tax is designed to provide a workaround for state tax limitations imposed at the federal level. Understanding NJ pass through entity tax is essential for businesses aiming to maximize tax advantages while ensuring compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.