Get Cfi Mobile App

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cfi Mobile App online

This guide provides a comprehensive overview of how to successfully complete the Cfi Mobile App disclosure statement on loan or credit transactions. Follow the instructions carefully to ensure all information is submitted accurately and efficiently.

Follow the steps to fill out the form correctly

- Click ‘Get Form’ button to access the document and open it for editing.

- Begin by entering the name of the borrower in the designated field. Make sure to double-check for any spelling errors.

- Next, input the address of the borrower in the address field, ensuring that all details are accurate and properly formatted.

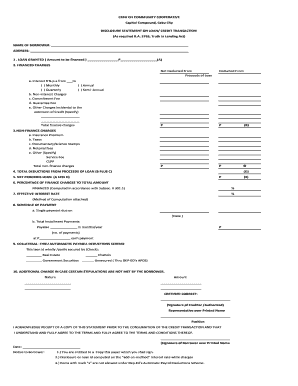

- For the loan granted section, enter the total amount to be financed. Label this figure as 'A'.

- Proceed to fill out the financed charges, starting with the interest rate. Indicate the percentage and select the appropriate frequency of payment, such as monthly, annual, quarterly, or semi-annual.

- Continue detailing any non-interest charges, such as the commitment fee, guarantee fee, and any other incidental charges. Specify each amount clearly.

- Next, complete the non-finance charges section by listing any applicable fees, including insurance premiums and taxes. Specify if these charges are deducted from the proceeds of the loan.

- Calculate the total deductions from the proceeds of the loan and label this total as 'D'. This includes all finance and non-finance charges.

- Determine the net proceeds loan by subtracting the total deductions from the loan amount, labeling this final figure as 'E'.

- Calculate the percentage of finance charges to the total amount financed and input this value accordingly.

- Compute the effective interest rate based on the provided method of computation and input this in the relevant field.

- Fill out the schedule of payment section, including the due date for any single payments and the total installment payments, broken down monthly or yearly.

- Indicate the collateral associated with the loan by checking the appropriate boxes for real estate, chattels, government securities, or unsecured status.

- Complete the additional charges section by describing any stipulations and the amounts associated with them, if applicable.

- Finally, ensure that all signatures are included. The creditor's representative must sign and print their name, followed by the signature of the borrower and date.

- Once everything is filled out, review all entries for accuracy before saving your changes. You may then download, print, or share the completed form as needed.

Complete your documents online now for a seamless experience.

Related links form

The CFI certificate is indeed legitimate and well-regarded within the finance community. Completing CFI courses demonstrates your knowledge and proficiency in corporate finance principles. When you utilize the CFI Mobile App, you embark on an educational journey that not only equips you with valuable skills but also provides a credible certification upon completion. You'll find that this certificate can open doors to new career opportunities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.