Loading

Get Commercial Loan Application Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Commercial Loan Application Template online

Filling out the Commercial Loan Application Template online is a straightforward process that allows users to provide essential information needed to apply for a loan. This guide will walk you through each section of the application, ensuring a smooth and efficient completion.

Follow the steps to successfully complete your application

- Click ‘Get Form’ button to access the Commercial Loan Application Template and open it in your preferred online editor.

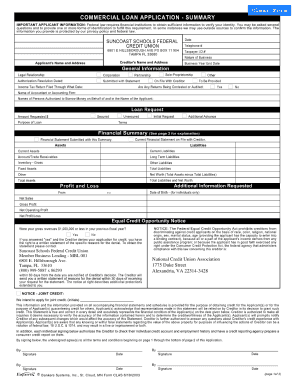

- Begin by entering your business information. This section typically requires the business name, address, and contact details. Be sure to provide accurate information, as this will be crucial for processing your application.

- Next, move to the loan details section. Here, indicate the amount you are requesting and specify the purpose of the loan. Clearly describing the intended use of funds can help the lender understand your needs.

- Proceed to the financial information section. This is where you will detail your business's financial history, including revenue, expenses, and other pertinent financial statements. Ensure that all figures are current and correct, as they will impact your loan eligibility.

- Review the personal information section. You may need to provide details about the owner(s) or partners in the business, including names, addresses, and social security numbers. This information helps assess the personal creditworthiness associated with the application.

- Finally, double-check all entries for accuracy. Once satisfied, use the options available to save changes, download a copy for your records, print, or share the completed form as necessary.

Complete your Commercial Loan Application Template online today to streamline your loan process!

The 4 Cs of lending are character, capacity, capital, and collateral. Character assesses the borrower's reliability and past financial behavior. Capacity evaluates the borrower's revenue and financial stability, while capital gauges the borrower's investment in the project or business. Collateral serves as a safeguard for the lender in case of default.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.