Loading

Get Ir401 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IR401 online

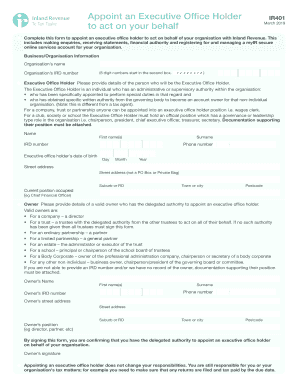

The IR401 form is essential for appointing an executive office holder to act on your behalf with the Inland Revenue. This guide provides a clear, step-by-step approach to help individuals and organizations complete the form accurately and effectively.

Follow the steps to complete the IR401 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the organization’s name and IRD number. The IRD number consists of eight digits, starting with the second box.

- Next, provide the details of the Executive Office Holder. Include their full name, IRD number, date of birth, phone number, street address (not a PO Box), suburb or RD, town or city, and postcode.

- Indicate the current position occupied by the Executive Office Holder, such as Chief Financial Officer.

- Now, provide the details of a valid owner who has the delegated authority to appoint the Executive Office Holder. This includes their name, IRD number, phone number, street address, suburb or RD, town or city, postcode, and position.

- Ensure that the form is signed by the owner, confirming their delegated authority to appoint the Executive Office Holder.

- Once all sections are completed, attach any necessary supporting documentation for both the Executive Office Holder and the owner, if required.

- Finally, save your changes, then download, print, or share the form as needed. You may also choose to scan and email, fax, or post the form to the Inland Revenue.

Complete your IR401 online to ensure smooth processing of your executive office holder appointment.

To submit an ADT, start by collecting all necessary financial documentation as outlined in the IR401 requirements. Ensure that your data is comprehensive and accurate to facilitate a smooth review process. You can submit your ADT either electronically through tax platforms or via traditional mailing methods. Making use of user-friendly platforms can enhance your filing experience significantly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.