Loading

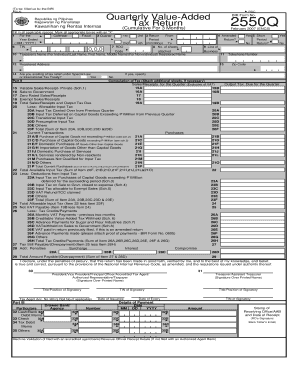

Get Bir Form 2550q Pdf 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 2550q Pdf online

This guide provides comprehensive instructions on how to fill out the Bir Form 2550q Pdf online, ensuring a smooth experience even for those with limited legal knowledge. Follow the detailed steps below to accurately complete your quarterly value-added tax return.

Follow the steps to successfully fill out the Bir Form 2550q Pdf online.

- Click the ‘Get Form’ button to access the Bir Form 2550q Pdf. This action will enable you to open the document in your online editor.

- Fill in the applicable spaces at the top of the form. Indicate the relevant quarter and year, along with your Taxpayer Identification Number (TIN) and Revenue District Office (RDO).

- Provide your business name or taxpayer's name in the designated section, ensuring accuracy for identification purposes.

- Indicate whether you are filing an amended return by marking the appropriate box with an “X” and specify the period covered.

- Proceed to Part II to compute your tax. Begin with vatable sales and receipts for the quarter, and complete all sales categories by inserting the correct figures.

- In this section, summarize your total sales/receipts and the output tax due. Deduct any allowable input tax items from your total.

- Continue to fill out details about your current purchases, ensuring that you categorize them correctly to reflect your tax obligations accurately.

- Review the deductions from input tax, ensuring all deductions are properly subtotaled and calculated.

- Finalize the computation by detailing any tax credits or payments made previously, and determine the net VAT payable or any overpayment.

- Complete the form with your signature and title, along with the date of filing, to authenticate your submission.

- Evaluate your form for completeness. You can now save any changes, download a copy of the completed form, print it out, or share it with your tax representative.

Start filling out your Bir Form 2550q Pdf online to ensure timely and accurate tax submission!

A quarterly VAT return must be filed within 25 days following the end of the quarter. Businesses must ensure timely filing to avoid penalties and interest on taxes due. To efficiently manage your VAT obligations, accessing documents like the Bir Form 2550q Pdf through reliable platforms like US Legal Forms is advisable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.