Loading

Get Iht217 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht217 online

Filling out the Iht217 form can be straightforward if you follow the right steps. This guide provides an expert analysis on completing the form online, ensuring you have the necessary information and guidance to proceed accurately and efficiently.

Follow the steps to fill out the Iht217 online successfully.

- Click the ‘Get Form’ button to obtain the form, which will open the document in your preferred editing tool.

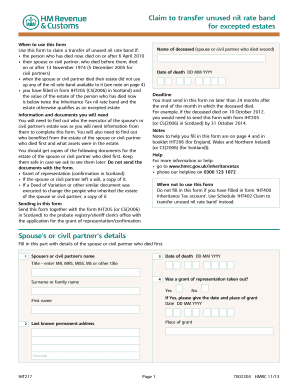

- Provide the name of the deceased spouse or civil partner who died second, along with their date of death in the format DD MM YYYY.

- Complete the section regarding your deceased spouse or civil partner's details, including their title, surname, first name, last known permanent address, and postcode.

- Fill in the date of marriage or civil partnership and the place where it took place.

- Indicate whether the spouse or civil partner was domiciled in the UK at the date of death by selecting 'Yes' or 'No'.

- Answer questions regarding the estate of the deceased spouse or civil partner, including whether a grant of representation was taken out.

- Continue answering all relevant questions about the estate, such as jointly owned assets, exemptions from Inheritance Tax, and gifts made before death.

- Enter the Inheritance Tax nil rate band applicable at the date of death of the spouse or civil partner who died second.

- Calculate the transfer amount by multiplying the figure from step 8 and follow the instructions provided in the form.

- Review and sign the declaration section, ensuring all necessary parties provide their signatures and dates before submission.

- Finally, save any changes made, and prepare to download, print, or share the completed Iht217 form as needed.

Complete your Iht217 form online today and ensure a smooth transfer of unused nil rate band.

To obtain your 18-digit National Insurance reference number online, visit the official government website. There, you will find resources to help you register or retrieve your reference. It's crucial for completing forms like IHT217 and ensures smooth processing. Be prepared to provide personal information for verification.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.