Loading

Get Surplus Funds For Deceased 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Surplus Funds For Deceased online

Filling out the Surplus Funds For Deceased form can be a crucial step in managing the financial matters of a deceased individual. This guide will provide you with clear, step-by-step instructions to help you complete the online form accurately and efficiently.

Follow the steps to complete the Surplus Funds For Deceased form online

- Press the ‘Get Form’ button to retrieve the form and open it in your chosen editing application.

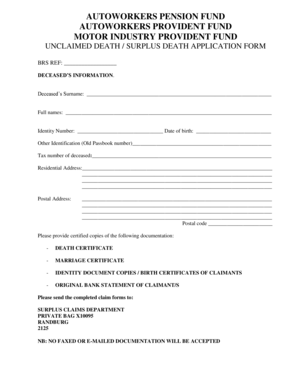

- Begin by entering the deceased’s information in the designated fields, including their surname, full names, identity number, date of birth, and any other identification details. Ensure that the information is accurate and clearly written in block letters.

- Provide the deceased’s tax number and residential address, followed by the postal address and postal code. Double-check these details for accuracy.

- Attach certified copies of the required documentation, including the death certificate, marriage certificate, identity document copies or birth certificates of claimants, and the original bank statement of the claimant(s).

- Fill out the particulars of any family member not living with the claimant, including their name, postal address, cell number, and their relationship to the deceased or claimant.

- Indicate whether the deceased had any children or dependants by selecting 'Yes' or 'No' and, if applicable, list their names, relationships, and dates of birth.

- In the claimant’s banking details section, fill in the account holder's name, name of the bank, branch code, account number, and type of account. Remember to include a stamped bank statement or bank enquiry printout.

- If the bank account holder is not the claimant, ensure that both the claimant and the account holder sign in the appropriate sections to authorize the payment.

- Complete the additional information regarding the deceased, such as previous marriages, custody details, and any child maintenance obligations. This helps in determining the distribution of benefits.

- Finally, review all the information provided, ensuring accuracy and completeness before signing and dating the form as the claimant. Save your changes and download or print the completed form.

Start filling out your Surplus Funds For Deceased form online today for a smooth claims process.

The formula for calculating surplus is straightforward: Surplus = Total Assets - Total Liabilities. This equation gives you insight into any surplus funds for deceased estates. By applying this formula, you can effectively manage the distribution of assets among beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.