Get Fillable Form 13 From Nebraska 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Form 13 from Nebraska online

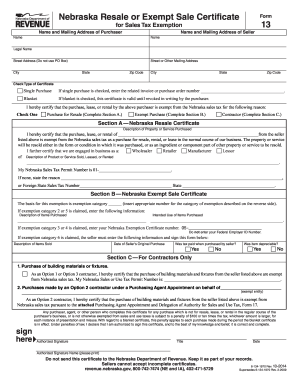

Filling out the Fillable Form 13 from Nebraska can seem daunting, but this guide provides straightforward steps to help you complete the form accurately and efficiently. Whether you are a business or a person seeking a sales tax exemption, this guide will walk you through each section with clarity.

Follow the steps to fill out the Fillable Form 13 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the name and mailing address of the purchaser. Ensure all details are accurate for future correspondence.

- Next, enter the name and mailing address of the seller. This section is crucial as it identifies the party from whom the goods or services are being purchased.

- Indicate the type of certificate by checking either ‘Single Purchase’ or ‘Blanket’. If you choose blanket, know that this certificate is valid until you revoke it in writing.

- Provide the reason for the exemption by checking one of the options: either ‘Purchase for Resale’, ‘Exempt Purchase’, or ‘Contractor’. Complete the corresponding sections based on your selection.

- If you selected ‘Purchase for Resale’, complete Section A by describing the item or service purchased and indicating the business type (wholesaler, retailer, manufacturer, or lessor). You will also need to enter your Nebraska Sales Tax Permit Number if applicable.

- If you indicated an ‘Exempt Purchase’, proceed to Section B. Insert the exemption category and provide the intended use and description of the items purchased as required.

- In Section C, if you are a contractor, certify your tax-free purchases of building materials or fixtures by entering your Sales or Consumer’s Use Tax Permit Number and any other necessary details.

- Do not forget to sign the form. The authorized signature, title, and date are essential for validating the certificate.

- Once you have completed all the sections, review the form for accuracy. Finally, you can save any changes, download, print, or share the completed form as needed.

Complete your forms online with confidence and ensure compliance with Nebraska sales tax regulations.

To acquire a Nebraska resale certificate, you need to complete an application process through the Nebraska Department of Revenue. This typically includes providing necessary documentation about your business operations. Using a Fillable Form 13 From Nebraska can greatly assist you in streamlining this process. With the right forms and information in hand, obtaining your resale certificate will be a more straightforward task.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.