Loading

Get Tax Exempt Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Exempt Form online

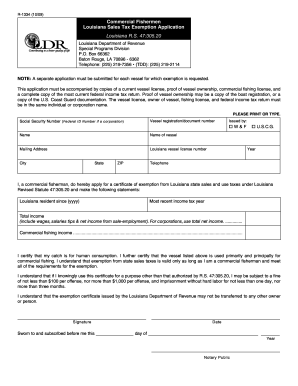

Filling out the Tax Exempt Form online is an essential process for commercial fishermen in Louisiana seeking to claim sales tax exemption. This guide provides step-by-step instructions to ensure you complete the form accurately and confidently.

Follow the steps to successfully complete your Tax Exempt Form online.

- Press the ‘Get Form’ button to acquire the Tax Exempt Form and open it for completion.

- Begin by entering your Social Security Number (or Federal ID Number if you are a corporation) in the designated field.

- Provide the vessel registration or document number, ensuring it is accurate.

- Indicate the entity that issued the vessel license by checking the appropriate box (W&F or U.S.C.G.).

- Fill in the name of the vessel and your mailing address. Ensure all information is correct, including city, state, and ZIP code.

- Enter your Louisiana vessel license number and the year of issuance.

- Provide your telephone number in the format (XXX) XXX-XXXX.

- State how long you have been a Louisiana resident by entering the year.

- Fill in the most recent income tax year and total income, including all relevant sources.

- Report your commercial fishing income in the specified section.

- Certify that your catch is intended for human consumption and affirm that your vessel is primarily used for commercial fishing.

- Sign and date the form. A notary public must also witness the signing.

- Once complete, save your changes, and download, print, or share the form as necessary.

Begin your process of obtaining the Tax Exempt Form online today!

Certain categories of individuals and organizations may be exempt from paying federal income taxes in the USA. Common exceptions include religious organizations, charities, and individuals with very low income. The Tax Exempt Form is essential for these organizations to formally apply for exemption status with the IRS. Understanding these distinctions can help you or your organization better manage your tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.