Loading

Get Ct 706nt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 706nt online

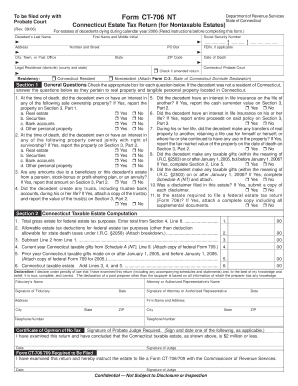

The Ct 706nt is a Connecticut estate tax return form specifically designed for nontaxable estates. This guide will take you through each section of the form, ensuring you understand what information to provide and how to complete it accurately.

Follow the steps to fill out the Ct 706nt correctly

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the decedent's last name, first name, and middle initial in the designated fields. Next, input the address, including the number and street, city or town, state, ZIP code, legal residence county and state, social security number, and FEIN if applicable.

- Indicate the date of death and check the applicable boxes for amended return and residency status.

- In Section 1, respond to the general questions by checking 'Yes' or 'No' for each asset type mentioned, including real estate, securities, and bank accounts. If any conditions apply, make sure to report the relevant properties in the specified sections.

- Proceed to Section 2, where you will compute the Connecticut taxable estate. Enter the total gross estate from Section 4, Line 8, allowable tax deductions, and current year taxable gifts.

- Fill out the declaration section with the fiduciary’s name and signature, along with the attorney or authorized representative’s details, ensuring all necessary signatures are included.

- Once all sections are filled out, review the form for accuracy. You can save your changes, download a copy for your records, print it if necessary, or share the form as needed.

Complete your Ct 706nt form online to ensure accurate and timely filing.

To file an estate tax return in CT, you must determine if the estate meets the threshold for filing. If it does, prepare the CT-706NT form and include accurate valuations for all estate assets. Be mindful of deadlines and consider any applicable deductions or credits. Utilizing platforms like US Legal Forms can help you access the necessary forms and guides to navigate this process with ease.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.