Loading

Get Rc4111 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rc4111 online

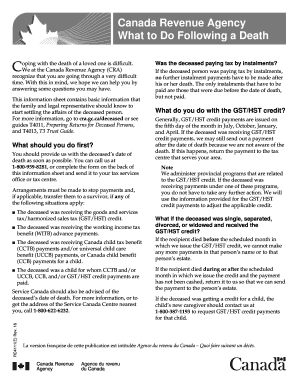

Filling out the Rc4111 form is an essential step in notifying the Canada Revenue Agency about the death of a loved one. This guide aims to provide clear and supportive instructions to help you navigate the process effectively.

Follow the steps to complete the Rc4111 form

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Carefully fill in the name of the deceased, ensuring you use their full legal name.

- Enter the deceased’s social insurance number accurately to avoid any discrepancies.

- Indicate the date of birth of the deceased using the format: year, month, day.

- Input the date of death in the same format: year, month, day.

- Complete the deceased's last known address to assist with proper record keeping.

- Provide details about the surviving spouse or common-law partner, including their name and social insurance number.

- Include your own name, date, phone number, and address as the person completing the form.

- Specify your relationship to the deceased, and identify if you are acting as their executor, administrator, or in another capacity.

- Once all fields are filled, review the information for accuracy, then save your changes.

- You can download, print, or share the form for mailing to the deceased’s tax centre.

Complete your documents online for efficiency and peace of mind.

The timeline for receiving a Canadian death certificate typically ranges from a few days to several weeks, depending on the province. Factors affecting this include the accuracy of submitted documents and the workload of the local office. To mitigate delays, verify that all required paperwork is complete and correct. Using Rc4111 can provide you with helpful tips for a quicker resolution.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.