Loading

Get Fae 172 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fae 172 online

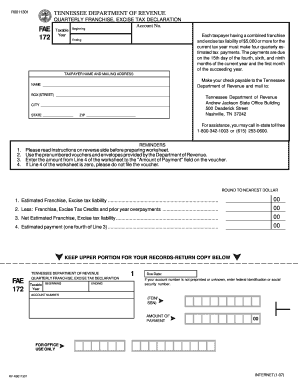

The Fae 172 is a critical quarterly franchise and excise tax declaration form required by the Tennessee Department of Revenue. This guide will walk you through each section and field of the form to ensure accurate and timely submission.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to access the Fae 172 and open it in the designated editor.

- Enter the account number for your business, or if it is not preprinted, include your federal identification or social security number at the top of the form.

- Fill in the taxable year information by indicating the beginning and ending dates for the period you are declaring.

- Provide your taxpayer name and mailing address. Ensure all fields for name, mailing box (street), city, state, and ZIP code are filled out accurately.

- In the payment section, specify the amount of payment due by calculating your estimated tax liability, following the guidelines provided in the form.

- For each estimated payment, round to the nearest dollar and enter the amounts in the designated fields, including any credits or prior year overpayments.

- Review your entries for completeness and correctness. It is essential to ensure that all calculated amounts reflect your estimates accurately.

- After completing the form, you may choose to save changes, download, print, or share the form as needed.

Complete your Fae 172 filing online today to ensure compliance with Tennessee tax regulations.

When mailing TN form FAE 170, you should send it to the designated address indicated on the instructions that accompany the form. This could vary based on whether you're filing for a corporation or an LLC. Double-checking the mailing address can prevent delays in processing your tax return. Consider using the uslegalforms platform for further clarification.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.