Loading

Get Form 3271.33 - Fannie Mae

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3271.33 - Fannie Mae online

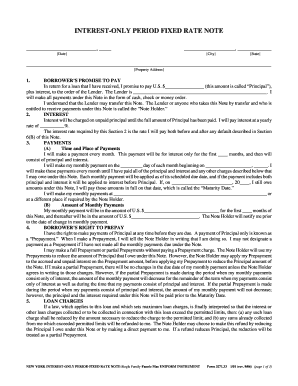

Filling out the Form 3271.33 - Fannie Mae is an important step in securing your fixed-rate loan. This guide will provide you with detailed, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the Form 3271.33 - Fannie Mae online.

- Press the ‘Get Form’ button to obtain the form and access it in your preferred document editor.

- Begin by filling in your name and the date at the top of the form. Ensure your name is exactly as it appears on your identification documents.

- In the section labeled 'Borrower’s promise to pay', indicate the principal amount you are borrowing in the designated field.

- Next, fill out the interest rate in the interest section; this will be the yearly rate applicable to your loan.

- In the section regarding the borrower's right to prepay, familiarize yourself with your right to make prepayments. If you intend to make any, restate your intentions in writing.

- Review the terms regarding default and late charges to ensure you understand your obligations. Make sure to fill in the late charge percentage.

- Finally, save your changes. You can download, print, or share the completed form as required.

Complete the Form 3271.33 - Fannie Mae online seamlessly by following these steps.

The 5% rule for Fannie Mae involves requirements around borrower contributions and creditworthiness. Specifically, it may pertain to the minimum down payment or investment needed for certain mortgage products. Familiarizing yourself with this rule supports your application process as outlined in Form 3271.33 - Fannie Mae.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.