Loading

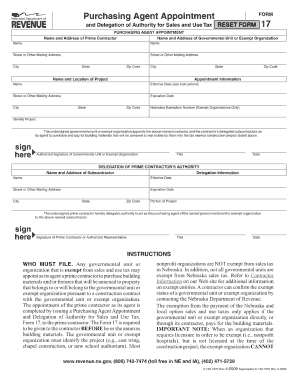

Get Form 17 Nebraska

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 17 Nebraska online

This guide provides clear, step-by-step instructions for filling out the Form 17 Nebraska online. Whether you are familiar with legal forms or new to the process, this guide will support you in completing your application accurately.

Follow the steps to fill out the form successfully.

- Click the ‘Get Form’ button to obtain the form and open it in your browser.

- Begin by providing your personal information in the designated fields, including your full name, address, and contact information. Ensure that all entries are accurate and up to date.

- Next, you will need to describe the purpose of the form. In the appropriate section, clearly state the reason for filing the Form 17, using specific details to convey your situation.

- Follow with any additional required information such as case numbers or identifications that pertain to your situation, if applicable. Take special care to align your entries with any guidelines provided.

- Review all entered information for accuracy and completeness before proceeding. Use this opportunity to make any necessary corrections to avoid delays.

- Once you are satisfied with the content of the form, you can choose to save your changes, download a copy for your records, print the form, or share it as needed.

Complete your documents online with ease and confidence!

Generally, most services are not taxable in Nebraska; however, there are exceptions, such as certain personal services and repair services. Understanding which services are subject to sales tax can be complex. For clarity on your specific situation, exploring resources available on platforms like uslegalforms can assist you in determining your obligations and helping you correctly apply forms like Form 17 Nebraska when needed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.