Loading

Get Vat D1 Form Download

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat D1 Form Download online

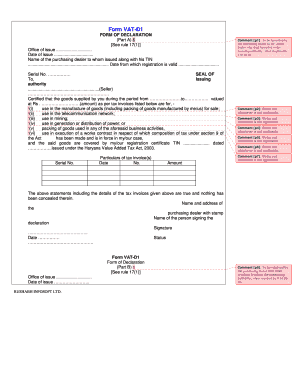

Filling out the Vat D1 Form Download is an essential step for businesses to claim tax exemptions on goods purchased. This guide will provide clear, step-by-step instructions to help you accurately complete the form online.

Follow the steps to successfully fill out the Vat D1 Form Download.

- Click the 'Get Form' button to obtain the Vat D1 Form and open it in your preferred online editor.

- Fill in the office of issue and the date of issue. This information is vital for establishing the legitimacy of the document.

- Enter the name of the purchasing dealer and their Tax Identification Number (TIN). Ensure that the TIN is correct to avoid processing issues.

- Specify the date from which the registration is valid and the serial number assigned to the form.

- In the areas provided, indicate the details of the goods supplied, specifically the period during which the goods were supplied and their total value as per the respective tax invoices.

- Select the appropriate use for the goods from the options provided, such as manufacturing or telecommunication. Strike out any options that do not apply.

- Fill in the particulars of the tax invoices, which include the date, number, and amount for each invoice related to the purchase.

- Provide the name and address of the purchasing dealer along with the stamp. This is necessary for verification purposes.

- The person signing the declaration must clearly write their name and title, affix their signature, and provide the date of signing.

- Once you have completed all sections, save your changes. You can download, print, or share the completed form as required.

Start filling out your documents online today for a smoother tax process!

Downloading the CSV file is a simple process. Access your VAT management system and look for the download options, typically located under data export functionalities. Utilizing the Vat D1 Form Download can make it easier to download your data in a structured format for better analysis.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.