Loading

Get Performance Bond 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Performance Bond online

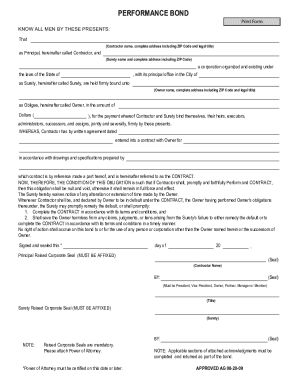

Filling out a Performance Bond online can be a crucial step in ensuring the security of a construction contract. This guide will provide you with clear, step-by-step instructions to help you complete the Performance Bond accurately and efficiently.

Follow the steps to fill out the Performance Bond online.

- Click ‘Get Form’ button to obtain the Performance Bond and open it in the designated editing interface.

- Begin by entering the contractor's details, including the name, legal status, and address in the designated fields.

- Next, provide the surety's information. Again, you will need to enter the name, legal status, and principal place of business.

- Fill in the owner's information by providing their name, legal status, and address. For this example, use 'Clarkstown Central School District, 62 Old Middletown Road, New City, NY 10956'.

- Indicate the construction contract's date, amount, and a brief description. For example, the description could be 'Fueling System and Tank Replacement at Clarkstown CSD Bus Garage'. Include the location as well.

- In the section titled 'Contractor as Principal', insert the company name and affix the corporate seal where applicable.

- For the surety section, repeat the company's name and ensure that the corporate seal is also present.

- Signatures from the contractor and surety representatives need to be included, along with their respective names and titles.

- Ensure that the bond's date is noted. It should not be earlier than the construction contract date.

- Review the bond for accuracy and completeness. Once verified, you can save changes, download, print, or share the form as needed.

Take the next step in your construction process by completing your Performance Bond online today.

The issuance of a performance bond involves submitting an application to a surety company, which reviews your application for adequacy and reliability. After assessing your creditworthiness and project specifics, the surety will issue a bond that serves as a financial guarantee. This process ensures that all parties are protected and can proceed with confidence.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.