Loading

Get Form 61

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 61 online

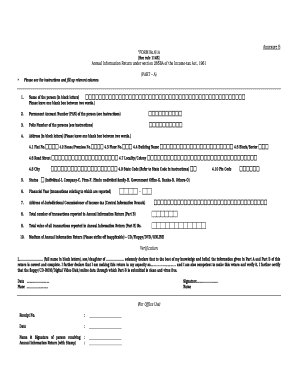

Filling out Form 61 is a crucial step in submitting your Annual Information Return under the Income-tax Act. This guide provides clear, step-by-step instructions for completing the form online, ensuring that you can successfully report your financial transactions with confidence.

Follow the steps to fill out Form 61 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the person in block letters. Be sure to leave one blank box between two words to ensure clarity and correct formatting.

- Input the Permanent Account Number (PAN) of the person as indicated in the instructions. This is a unique identifier required for taxation purposes.

- Provide the Folio Number of the person as specified in the instructions. This number is essential for reference in your return.

- Complete the address section in block letters, ensuring to leave one blank box between each word. Fill in all applicable fields: Flat No., House/Premises No., Floor No., Building Name, Block/Sector, Road/Street, Locality/Colony, City, State Code, and Pin Code.

- Specify the status of the person as individual, company, firm, or other as outlined in the form.

- Indicate the financial year for which transactions are reported. This should correspond with the period of activity indicated in your return.

- Fill in the address of the jurisdictional Commissioner of Income-tax as required.

- Enter the total number of transactions reported in Part B of the form.

- Calculate and input the total value of all transactions reported in Part B in Rupees.

- Select the medium of submission for the Annual Information Return. Mark the relevant option: CD/Floppy/DVD/ONLINE.

- In the verification section, provide the full name in block letters, relationship status, and confirm the correctness of the information. Include the date and place of submission, along with your signature.

- Once all fields are complete, review the form for accuracy. You have options to save changes, download, print, or share the form as required.

Start completing your Form 61 online today for a smooth filing experience.

Form 61A is used to report certain types of financial transactions to tax authorities when a PAN is not available. It serves as a means for individuals and organizations to declare their transactions and remain compliant with tax regulations. Utilizing Form 61A ensures that you meet your tax obligations, promoting responsible financial practices.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.