Loading

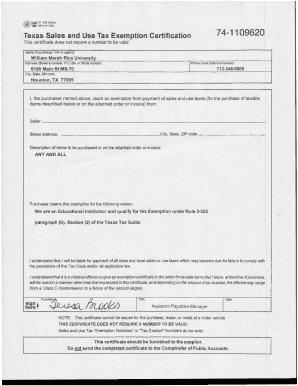

Get Rice Tax Exempt Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rice Tax Exempt Form online

Navigating the Rice Tax Exempt Form can seem daunting, but with the right guidance, you can complete it easily online. This guide will provide you with a clear understanding of each section and help you successfully submit your form.

Follow these steps to complete the form accurately.

- Press the 'Get Form' button to obtain the Rice Tax Exempt Form and open it in your preferred document editor.

- In the first section, enter the name of the purchaser, firm, or agency. For example, 'William Marsh Rice University'.

- Provide the complete address, including the street address, P.O. box or route number. For instance, input '6100 Main St MS-70, Houston, TX 77005'.

- Enter a valid phone number including the area code. You could use '713-348-0000' as an example.

- Identify the seller's name and address. This should include the seller's street address, city, state, and ZIP code.

- In the description of items to be purchased, specify the items or input 'ANY AND ALL' if applicable.

- In the reason for claiming the exemption, state that you are an educational institution, like so: 'We are an Educational Institution and qualify for the exemption under Rule 3-322, paragraph (b), Section (2) of the Texas Tax Guide.'

- Sign the certificate where indicated, and include your title and the date of signing.

- Ensure that the certificate is only provided to the supplier and not submitted to the Comptroller of Public Accounts.

- After completing all fields, you can save changes, download the filled form, or print it for sharing.

Complete your Rice Tax Exempt Form online today!

Related links form

Harvard University also has a tax exemption number that indicates its nonprofit status, similar to Rice University. This number is crucial for managing donations and financial reporting. You may find Harvard's tax exemption number through official university resources, or by contacting their financial services department. Understanding the use of tax exemption numbers can be made easier with the guidance provided in the Rice Tax Exempt Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.