Loading

Get Dr 501sc 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr 501sc online

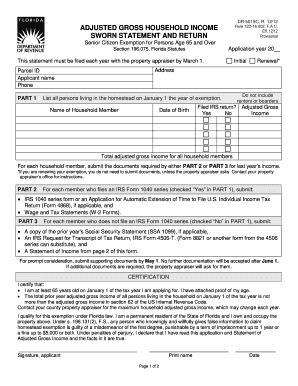

The Dr 501sc is a crucial form for individuals aged 65 and over seeking a senior citizen exemption in Florida. This guide provides a clear, step-by-step approach to filling out the form online, ensuring that you understand each component and can complete it accurately.

Follow the steps to complete the Dr 501sc online effectively.

- Press the ‘Get Form’ button to access the form and open it in your browser.

- Complete your personal information, including your name, address, and phone number. This information is crucial for the processing of your application.

- In PART 1, list all individuals living in the homestead as of January 1 of the application year. Provide the name and date of birth for each household member.

- Indicate whether each household member has filed an IRS return by selecting 'Yes' or 'No' and report their adjusted gross income.

- Depending on your response in PART 1, if you answered 'Yes,' go to PART 2 and submit the required IRS forms including IRS 1040 series and W-2 forms.

- If you answered 'No' in PART 1, proceed to PART 3 and include supporting documents such as Social Security Statements and income transcripts as needed.

- After filling in all necessary sections, review the information for accuracy. Make sure all required documents are attached.

- In the certification section, confirm your eligibility for the exemption by marking that you are at least 65 years old, attaching proof of age, and signing the form.

- Finally, save your changes, download, print a copy for your records, and submit the completed form to your local property appraiser's office by the deadline.

Start filling out the Dr 501sc online today to secure your senior citizen exemption.

The deadline for filing homestead exemption in Florida is typically March 1st of the year you are applying. If you miss this date, you may have to wait a full year to apply. Using Dr 501sc allows you to stay on track with important deadlines and submission guidelines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.